You cannot close a period in Payables if any of the following conditions exist:

o Outstanding payment batches. Confirm or cancel all incomplete payment batches.

o Future dated payments for which the Maturity Date is within the period but that still have a status of Issued.

o Unaccounted transactions. Submit the Payables Accounting Process to account for transactions, or submit the Unaccounted Transaction Sweep to move any remaining unaccounted transactions from one period to another.

o Accounted transactions that have not been transferred to general ledger. Submit the Payables Transfer to General Ledger process to transfer accounting entries.

To complete the close process in Payables:

1. Validate all invoices.

Run Invoice Validation Concurrent program.

2. Confirm or cancel all incomplete payment batches.

3. If you use future dated payments, submit the Update Matured Future Dated Payment Status Program. This will update the status of matured future dated payments to Negotiable so you can account for them.

4. Resolve all unaccounted transactions.

Submit the Payables Accounting Process to account for all unaccounted transactions. Review the Unaccounted Transactions Report. Review any unaccounted transactions and correct data as necessary.

Then resubmit the Payables Accounting Process to account for transactions you corrected. Or move any unresolved accounting transaction exceptions to another period (optional).

o Payables Accounting Process.

o Submit the Unaccounted Transactions Sweep Program.

5. Transfer invoices and payments to the General Ledger and resolve any problems you see on the output report:

o Payables Transfer to General Ledger Program.

6. In the Control Payables Periods window, close the period in Payables.

o Controlling the Status of Payables Periods.

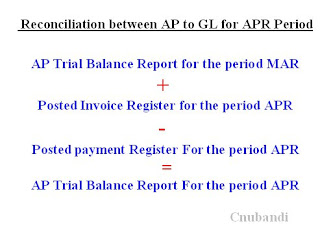

7. Reconcile Payables activity for the period. You will need the following reports:

o Accounts Payable Trial Balance Report (this period and last period).

o Posted Invoice Register.

o Posted Payment Register.

8. If you use Oracle Purchasing, accrue uninvoiced receipts.

9. If you use Oracle Assets, run the Mass Additions Create Program transfer capital invoice line distributions from Oracle Payables to Oracle Assets.

10. Post journal entries to the general ledger and reconcile the trial balance to the General Ledger.