1. What are the types of invoices?

2. What is difference between debit memo and credit memo?

3. What is meant by with-holding tax invoice?

4. What are the mandatory setups in AP?

5. What is the difference between PO default and quick match?

6. Use of recurring invoice?

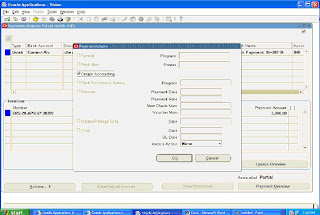

7. Steps for payment batch?

8. Purpose of Payable invoice open interface?

9. Payable open interface import? (Expense Report Import)

10. Multi Currency payments?

11. Can we implement MRC at Payables?

12. Use of Distribution set?

13. Accounting Methods?

14. Use of automatic offset method?

15. What does the Unaccounted Transaction Sweep Report do?

16. What reports should I run before closing the period?

17. What is the program to transfer data from AP to GL?

18. What is meant by void payments?

19. What are the types of journal categories available in the AP?

20. What is meant by matching and what are the types of matchings available?

21. Types of Prepayments? And difference between them?

22. What is a Hold and Release

23. How to approve ‘n’ no. of invoices

24. What is Zero-Payment in AP

25. What is Proxima Payment Terms?

26. What are the tables associated with Invoice?

27. Which interface tables are used for Invoice Import?

28. What is 2 way, 3 way and 4 way matching?

29. What is Interest Invoice and how it can be created?

30. How many key flexfields are there in Payables?

31. Can you cancel the invoice? If yes, explain?

32. What is pay date basis?

33. What is terms date basis?

34. What is the report used to identify duplicate suppliers?

35. Difference between header level tax calculation and line level tax calculation?

36. What is meant by accrual write off?

37. Difference between quick payment and manual payment?

38. Use of Future dated payments?

39. Tell me steps for Period closing Process in AP?

40. Payable And Financial options?

41. What is meant by third party payments?

42. How to transfer funds between your internal banks?

43. Invoice Approval Process?

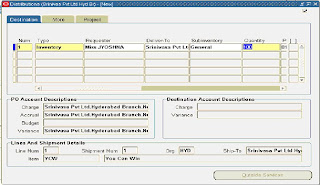

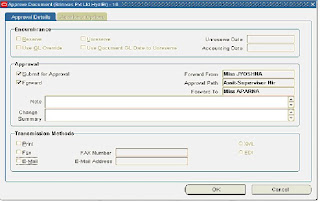

44. Can I find out which invoices are matched to a PO?

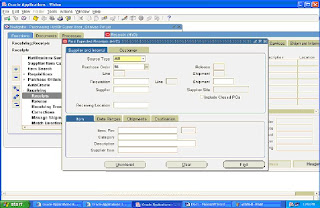

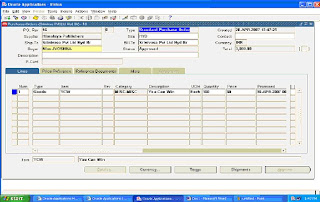

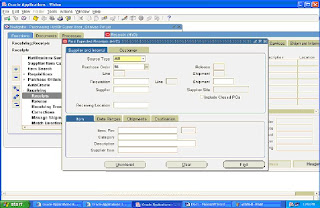

45. What is Intercompany Invoicing?

46. ERS Invoice means?

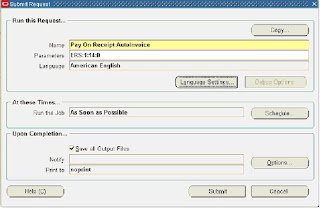

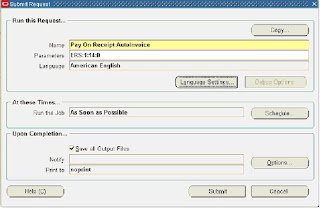

47. Use of Pay on receipt auto invoice?

48. What is meant by RTS transactions?

49. What are the steps to define a Bank?

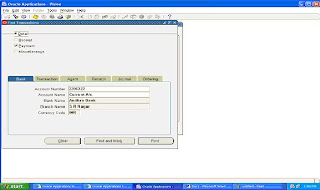

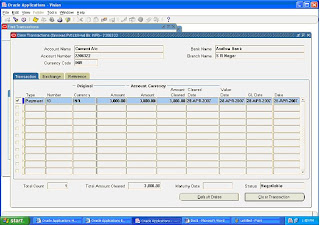

50. Payment Methods?

Friday, December 7, 2007

Friday, November 2, 2007

Difference between multiple databases, multiple instances, and multiple installations?

In Oracle database terminology, an instance is the combination of background processes and memory structures that allow the user to access data in an Oracle database. In an applications context, instance and database are often used interchangeably.Multiple installations, or "installs" means that Oracle Applications are installed multiple times on a single database.Multiple databases or instances refer to a scenario in which there may exist numerous databases, each with one or more installations and implementations of the Oracle Applications.

In Oracle database terminology, an instance is the combination of background processes and memory structures that allow the user to access data in an Oracle database. In an applications context, instance and database are often used interchangeably.Multiple installations, or "installs" means that Oracle Applications are installed multiple times on a single database.Multiple databases or instances refer to a scenario in which there may exist numerous databases, each with one or more installations and implementations of the Oracle Applications.

Sunday, October 7, 2007

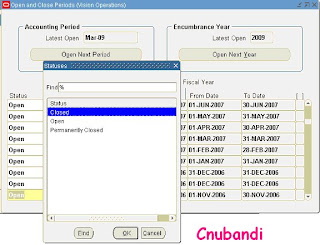

Period status in General Ledger

Open: In the Open status you can enter and post Journals.

Closed: In this status Journal entry and posting not allowed until accounting period is reopened. Reporting and inquiry allowed.

Permanently Closed: In this status Journal entry and posting not allowed. You cannot change this period status. Reporting and inquiry allowed. You can change the status.

Never Opened: Journal entry and posting are not allowed. General Ledger assigns this status to any period preceding the first period ever opened in your

calendar, or to any period that has been defined, but is not yet future-enterable. You cannot change this period status.

Future-Entry: Journal entry is allowed, but posting is not. Your period is not yet open, but falls within the range of future-enterable periods you designated in the Set of Books window. You cannot change this period status without using the concurrent process to open the period.

Thursday, September 20, 2007

Recurring Journals

Define recurring journal formulas for transactions that you repeat every accounting period, such as accruals, depreciation charges, and allocations.

You can use recurring journals to create three types of journal entries:

Skeleton Journal Entries: Skeleton journals have varying amounts in each period. You define a recurring journal entry with out amounts, and then enter the appropriate amounts each accounting period.

There are no formulas to enter, only account combinations. For example, you can record temporary labor expenses in the same account combination every month with varying amount due to fluctuations in hours..

Standard Recurring Journal Entries: Standard recurring journal entries use the same accounts and amounts each period.

For Example: Record monthly lease expenses with constant amounts charged to the same account.

Recurring Journal Formula Entries: Formula entries use formulas to calculate journal amounts that vary from period to period. For example, calculate commotion to sales representative based on the sales of the month.

You can use recurring journals to create three types of journal entries:

Skeleton Journal Entries: Skeleton journals have varying amounts in each period. You define a recurring journal entry with out amounts, and then enter the appropriate amounts each accounting period.

There are no formulas to enter, only account combinations. For example, you can record temporary labor expenses in the same account combination every month with varying amount due to fluctuations in hours..

Standard Recurring Journal Entries: Standard recurring journal entries use the same accounts and amounts each period.

For Example: Record monthly lease expenses with constant amounts charged to the same account.

Recurring Journal Formula Entries: Formula entries use formulas to calculate journal amounts that vary from period to period. For example, calculate commotion to sales representative based on the sales of the month.

Sunday, September 2, 2007

Purchasing FAQ’s

1. Define Requition?

2. What are the types of requitions?

3. What is the use of requition template?

4. What is the procedure for requition import?

5. What is meant by RFQ?

6. What are the types of RFQ”S?

7. What is meant by quatation and quotation analysis?

8. What is meant my PO?

9. What are the types of PO?

10. What are the types of receipts?

11. What is meant by receipt routing?

12. What is the purpose of receiving transactions?

13. What is meant by receipt routing? Types?

14. What is the use of auto creat?

15. What is meant by pay on receipt auto invoice?

16. What do you mean by controlling buyers workload?

17. What is Matching? What are the various methods of matching?

18. What is the use of defining security hierarchy?

19. What is the difference between accrue at period end and accrue on receipt?

20. Why are expenses items typically accrued at period end, and why are inventory items always accrued on receipt?

2. What are the types of requitions?

3. What is the use of requition template?

4. What is the procedure for requition import?

5. What is meant by RFQ?

6. What are the types of RFQ”S?

7. What is meant by quatation and quotation analysis?

8. What is meant my PO?

9. What are the types of PO?

10. What are the types of receipts?

11. What is meant by receipt routing?

12. What is the purpose of receiving transactions?

13. What is meant by receipt routing? Types?

14. What is the use of auto creat?

15. What is meant by pay on receipt auto invoice?

16. What do you mean by controlling buyers workload?

17. What is Matching? What are the various methods of matching?

18. What is the use of defining security hierarchy?

19. What is the difference between accrue at period end and accrue on receipt?

20. Why are expenses items typically accrued at period end, and why are inventory items always accrued on receipt?

Saturday, September 1, 2007

Sunday, August 12, 2007

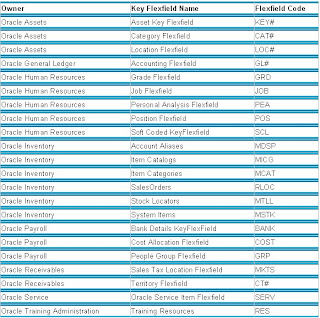

key flexfield

key flexfield is a field made up of segments, where each segment has both a value and a meaning. You can think of a key flexfield as an “intelligent” field that your business can use to store information represented as “codes.”

Most organizations use ”codes” made up of meaningful segments to identify general ledger accounts, part numbers, and other business entities. Each segment of the code can represent a characteristic of the entity. For example, consider an account number for a bank. A complete bank number may consists of various segments like the country code, area code, city code, branch code, account type, account number etc

What is SQL*Loader and what is it used for?

SQL*Loader is a bulk loader utility used for moving data from external files into the Oracle database. Its syntax is similar to that of the DB2 Load utility, but comes with more options. SQL*Loader supports various load formats, selective loading, and multi-table loads

Friday, August 10, 2007

Introduction to TOAD

TOAD is powerful development tool to build an advanced SQL/PLSQL . Using TOAD, developers can build and test PL/SQL packages, procedures, triggers and functions. You can create and edit database tables, views, indexes, constraints and users. Simply, the GUI object browser provide quick access to database object.

Author:

Cnu Bandi

Wednesday, July 25, 2007

Thanq verymuch

Hai Friends....

Thanq verymuch for your feed back.

I will try to post more topics,wich is useful for jobseekers.

I'm very happy to inform you that ,I'm going to introduse one discussion forum.

All of you can join and share your quiries and stuff relating to oracle applications.

With Regards,

Cnubandi.

Thanq verymuch for your feed back.

I will try to post more topics,wich is useful for jobseekers.

I'm very happy to inform you that ,I'm going to introduse one discussion forum.

All of you can join and share your quiries and stuff relating to oracle applications.

With Regards,

Cnubandi.

Author:

Cnu Bandi

Tuesday, July 10, 2007

Multiple Reporting Currencies

The Multiple Reporting Currencies (MRC) is the set of unique feature embedded in Oracle applications, which allows you to report on and maintain accounting at the transaction level in more than one functional currency. MRC is based on the Multi-Org Architecture, and is a significant aspect of a globalization strategy.

The primary functional currency is the currency you use to record transactions and maintain your accounting data within the Oracle E-Business Suite. In the primary set of books, the functional currency is always the primary functional currency. Usually, the primary functional currency is the currency in which you perform most of your business transactions, and the one you use for legal reporting.

A reporting set of books is a financial reporting entity associated with a primary set of books. While the reporting set of books has the same chart of accounts and accounting calendar as the primary set of books, its use of a different functional currency (reporting functional currency) allows you to report in a different functional currency than that of your primary set of books.

You must define a separate set of books for each of your reporting functional currencies. By using MRC concept we can maintain up to Eight Reporting Set Of Books.

The primary functional currency is the currency you use to record transactions and maintain your accounting data within the Oracle E-Business Suite. In the primary set of books, the functional currency is always the primary functional currency. Usually, the primary functional currency is the currency in which you perform most of your business transactions, and the one you use for legal reporting.

A reporting set of books is a financial reporting entity associated with a primary set of books. While the reporting set of books has the same chart of accounts and accounting calendar as the primary set of books, its use of a different functional currency (reporting functional currency) allows you to report in a different functional currency than that of your primary set of books.

You must define a separate set of books for each of your reporting functional currencies. By using MRC concept we can maintain up to Eight Reporting Set Of Books.

Author:

Cnu Bandi

Sunday, June 24, 2007

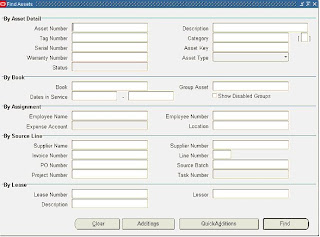

Assets Additions

Asset Setup Processes (Additions)

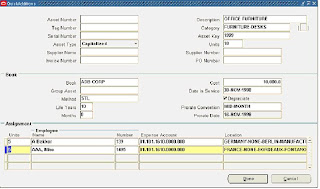

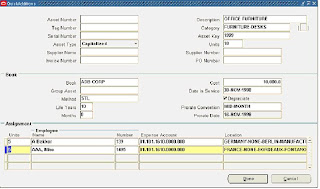

Quick Additions

Use the Quick Additions process to quickly enter ordinary assets when you must enter them manually. You can enter minimal information in the Quick Additions window, and the remaining asset information defaults from the asset category, book, and the date placed in service.

To add an asset quickly accepting default information:

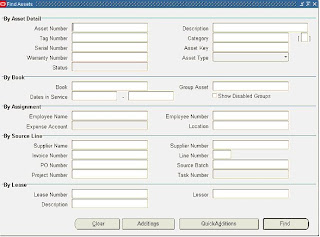

1.Choose Assets > Asset Workbench from the Navigator window.

2.Choose Quick Additions from the Find Assets window.

The following screen appears.

3. Enter a Description of the asset.

4. Enter the asset Category.

5. Select the Asset Type of the asset. For a description of the assets types, see: Asset Descriptive Details

6. Assign your asset to a corporate depreciation Book.

7. Enter the current Cost.

8. Optionally update the Date Placed In Service.

9. Update the depreciation method and prorate convention, if necessary. The depreciation method and prorate convention are defaulted from the category default rules. However, you can update them here.

10. Assign the asset to an Employee Name (optional), a general ledger depreciation Expense Account, and a Location.

11. Click on the Done Button.

System displays the following Message.

Quick Additions

Use the Quick Additions process to quickly enter ordinary assets when you must enter them manually. You can enter minimal information in the Quick Additions window, and the remaining asset information defaults from the asset category, book, and the date placed in service.

To add an asset quickly accepting default information:

1.Choose Assets > Asset Workbench from the Navigator window.

2.Choose Quick Additions from the Find Assets window.

The following screen appears.

3. Enter a Description of the asset.

4. Enter the asset Category.

5. Select the Asset Type of the asset. For a description of the assets types, see: Asset Descriptive Details

6. Assign your asset to a corporate depreciation Book.

7. Enter the current Cost.

8. Optionally update the Date Placed In Service.

9. Update the depreciation method and prorate convention, if necessary. The depreciation method and prorate convention are defaulted from the category default rules. However, you can update them here.

10. Assign the asset to an Employee Name (optional), a general ledger depreciation Expense Account, and a Location.

11. Click on the Done Button.

System displays the following Message.

Author:

Cnu Bandi

Tuesday, June 19, 2007

Payables Reports Listing

Hai Friends...

You can find Reports Listing in the following Link.

http://cnubandi.googlepages.com/oraclepayablesreportslisting

You can find Reports Listing in the following Link.

http://cnubandi.googlepages.com/oraclepayablesreportslisting

Monday, June 18, 2007

Friday, June 15, 2007

Journal source and categories

Journal source and categories is used to differentiate journal entries and to enhance your audit trail.

Journal entry source indicates where your journal entries originate

Journal categories help you differentiate entries by purchase or type.

Examples for Sources:

Assets

Purchasing

Payables

Manual

Budget …...Etc.

Examples For Categories:

Accruals

Adjustment

Receipts

Revaluation

Payments..Etc..

Oracle applications provided required source and categories with default. But you can define with your sauce and categories by using the following navigation:

GL:Setup->Journal->Source

Setup->journal-.Categories

With Journal Source you can:

Define inter company and suspense accounts for specific sources.

Run auto post program for specific source

Import journals by source

Freeze journals imported from sub ledgers to prevent users from making changes.

If you have journal approval enabled for your set of books, you can use journal source to enforce management approval of journal before they are posted.

With Journal Categories you can:

Define inter company and suspense accounts for specific category.

Use document sequence to sequentially number journals by categories.

Journal entry source indicates where your journal entries originate

Journal categories help you differentiate entries by purchase or type.

Examples for Sources:

Assets

Purchasing

Payables

Manual

Budget …...Etc.

Examples For Categories:

Accruals

Adjustment

Receipts

Revaluation

Payments..Etc..

Oracle applications provided required source and categories with default. But you can define with your sauce and categories by using the following navigation:

GL:Setup->Journal->Source

Setup->journal-.Categories

With Journal Source you can:

Define inter company and suspense accounts for specific sources.

Run auto post program for specific source

Import journals by source

Freeze journals imported from sub ledgers to prevent users from making changes.

If you have journal approval enabled for your set of books, you can use journal source to enforce management approval of journal before they are posted.

With Journal Categories you can:

Define inter company and suspense accounts for specific category.

Use document sequence to sequentially number journals by categories.

Author:

Cnu Bandi

Tuesday, June 12, 2007

Use Of Automatic Offset Method In Payable Options

If you enter an invoice for expenses or asset purchases for more than one balancing segment, you might want to use automatic offset method to keep your payables transaction accounting entries balanced.

If we enable balancing as a automatic offset, payable builds the offset GL account by taking the balancing segment value from the invoice distribution and overlaying it on to the appropriate GL account, i.e liability account from the supplier site.

If we enable account as automatic offset, it takes the opposite approach with one segment being retained from the default GL account and all other segments being retained from the invoice distribution

If we enable balancing as a automatic offset, payable builds the offset GL account by taking the balancing segment value from the invoice distribution and overlaying it on to the appropriate GL account, i.e liability account from the supplier site.

If we enable account as automatic offset, it takes the opposite approach with one segment being retained from the default GL account and all other segments being retained from the invoice distribution

Author:

Cnu Bandi

Sunday, June 10, 2007

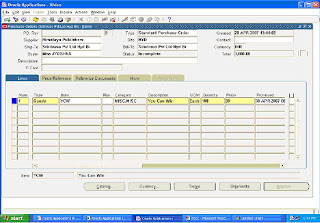

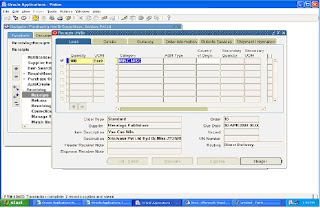

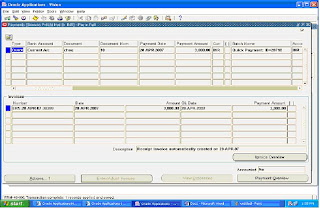

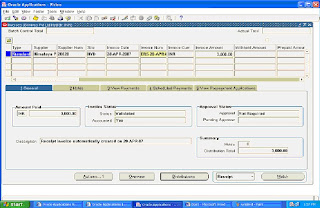

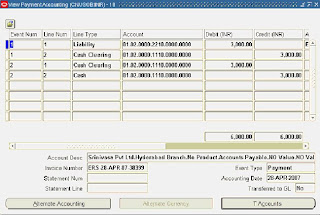

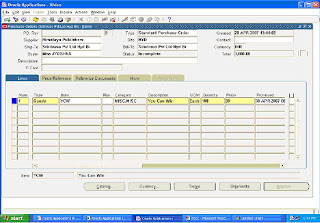

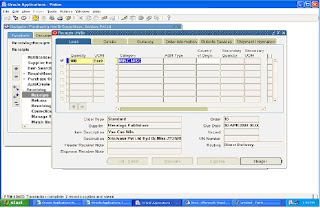

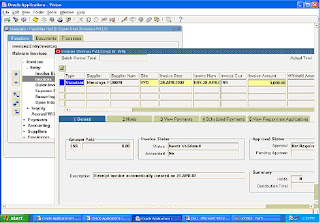

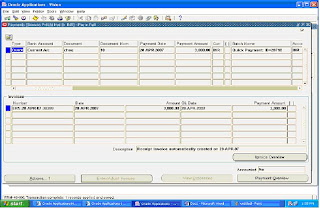

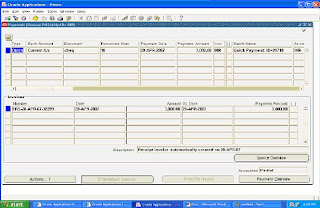

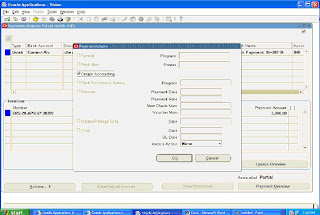

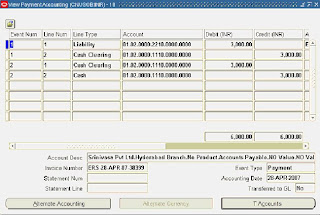

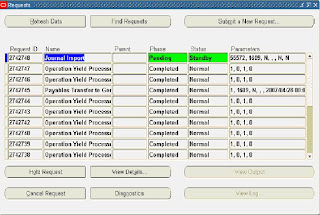

Procure To Pay Cycle Process

1. Create a Standard Purchase order.

2. Give Shipments

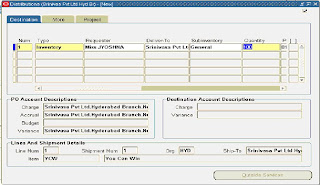

3. Give Distributions

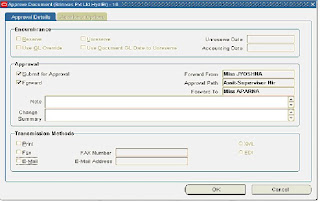

4. Approve PO

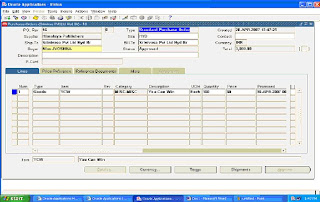

5. See the status of the PO In The header level: It is approved.

6. Go to the ReceivingàReceipts

7. Give the sub inv and stock locator where you want store the goods. And Save.

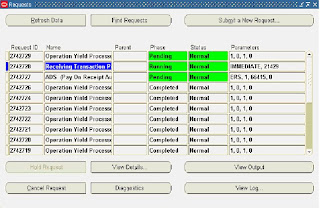

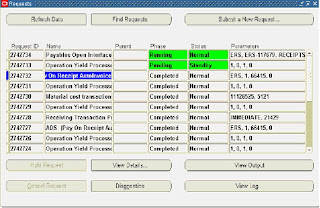

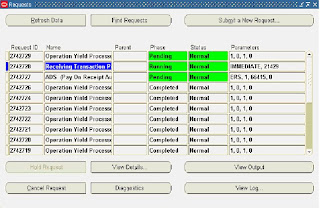

8. View the request status and refresh If not Completed.

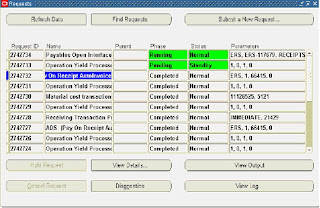

9. Run the Program Pay on receipt auto invoice.(Which Generate Invoice Automatically)

10. View the Status of the program and refresh if not completed.

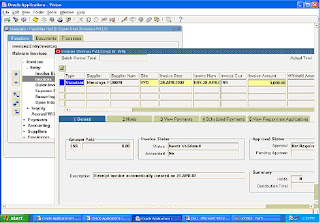

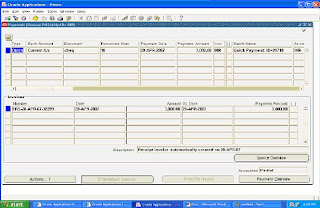

11. Go to Payables: InvoiceàEntry àInvoice

Query with the Invoice Num ERS%

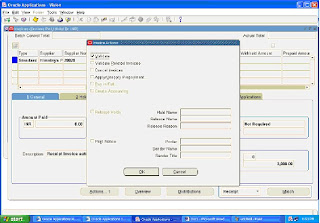

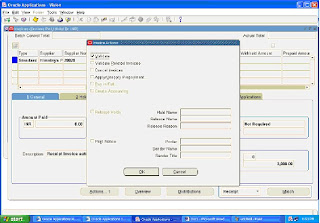

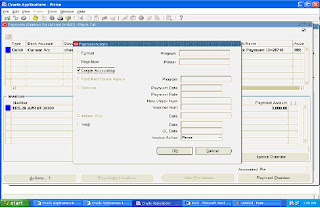

12. Validate the Invoice .After Validate Enable the creating Accounting check box.

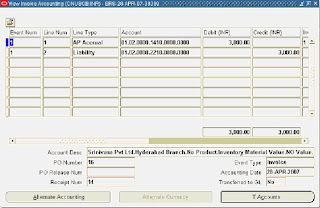

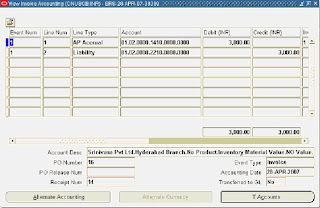

13.See The Account

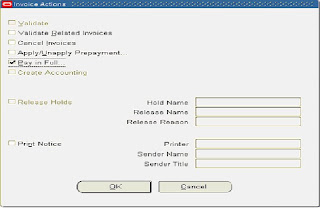

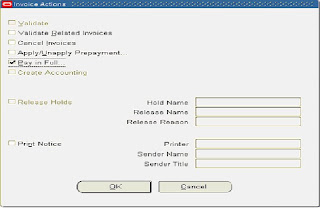

14. Enable the check box Pay in full. And Pres ok.

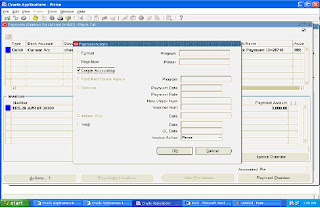

15. Select the Bank and Go to Actions

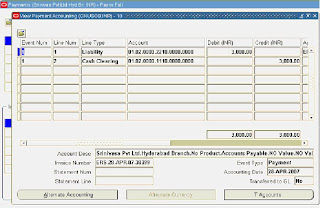

16. Enable the check box Create Accounting and press ok.

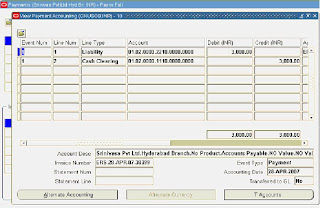

17. See the Account Created.

18. Now see the invoice status validated, accounted and amount paid.

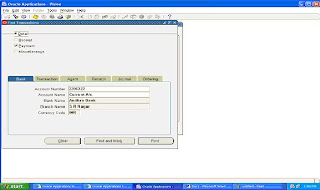

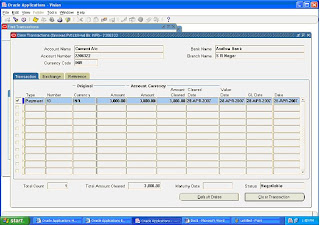

19. Go to Cash Management: Bank Statementsà Manual clearing. àClear Transactions

Find the Bank Account.

20. Enable the Transaction and press Clear Transaction Button.

21. Go to Payables: PaymentàEntryàPayment

Query with Payment Date

22. Go to actions, enable Create Accounting and press ok.

23. See the Account created.

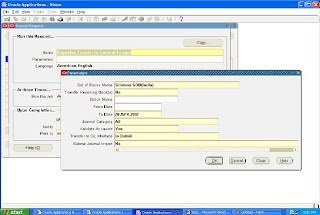

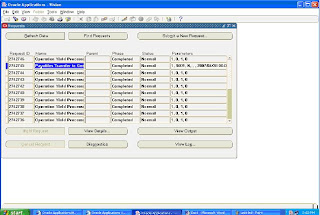

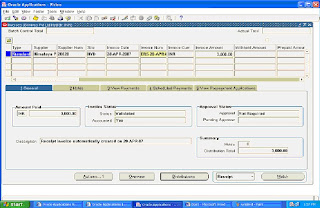

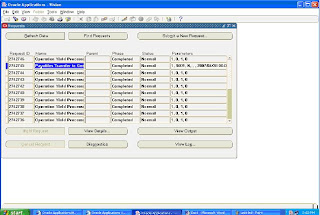

24. Run: Payables Transfer to General Ledger.

25.View the Request status and refers if not completed.

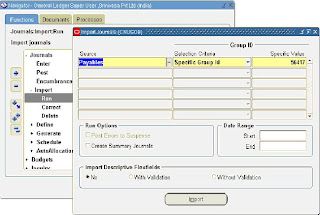

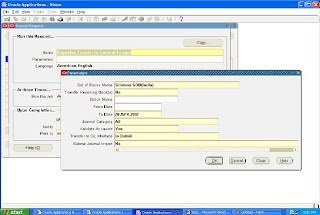

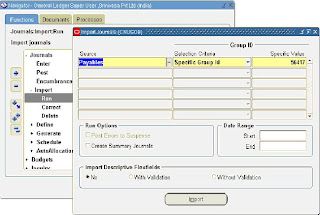

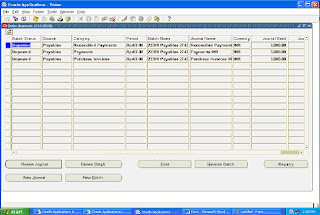

26.Got to GL:JournalàImportàRun

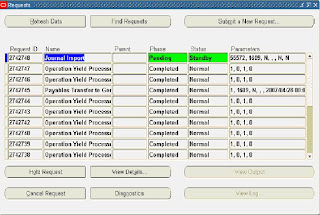

27.View the request status and refers if not completed.

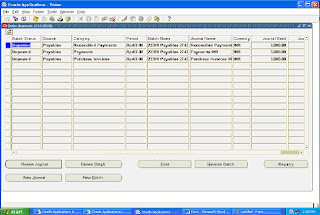

28. Go to JournalsàEnter .Find with Source as Payables.

29.Now We can Post the journals.

2. Give Shipments

3. Give Distributions

4. Approve PO

5. See the status of the PO In The header level: It is approved.

6. Go to the ReceivingàReceipts

7. Give the sub inv and stock locator where you want store the goods. And Save.

8. View the request status and refresh If not Completed.

9. Run the Program Pay on receipt auto invoice.(Which Generate Invoice Automatically)

10. View the Status of the program and refresh if not completed.

11. Go to Payables: InvoiceàEntry àInvoice

Query with the Invoice Num ERS%

12. Validate the Invoice .After Validate Enable the creating Accounting check box.

13.See The Account

14. Enable the check box Pay in full. And Pres ok.

15. Select the Bank and Go to Actions

16. Enable the check box Create Accounting and press ok.

17. See the Account Created.

18. Now see the invoice status validated, accounted and amount paid.

19. Go to Cash Management: Bank Statementsà Manual clearing. àClear Transactions

Find the Bank Account.

20. Enable the Transaction and press Clear Transaction Button.

21. Go to Payables: PaymentàEntryàPayment

Query with Payment Date

22. Go to actions, enable Create Accounting and press ok.

23. See the Account created.

24. Run: Payables Transfer to General Ledger.

25.View the Request status and refers if not completed.

26.Got to GL:JournalàImportàRun

27.View the request status and refers if not completed.

28. Go to JournalsàEnter .Find with Source as Payables.

29.Now We can Post the journals.

Author:

Cnu Bandi

Thursday, June 7, 2007

Secondary Tracking Segment

Secondary Tracking Segment is a Flex field qualified added in the 11.5.10 release. The secondary tracking segment is used in the revaluation, translation, and fiscal year-end close processes. The system will automatically maintain unrealized gain/loss, retained earnings, and cumulative translation adjustments by unique pairs of balancing segment and secondary tracking segment values. you can assign Secondary tracking segment flex field qualifier to an segment which haven’t assigned Natural account, balensing Segment and inter company.

Author:

Cnu Bandi

Friday, May 25, 2007

Assets Frequently Asked Questions

1. What are the different ways of adding assets in FA?

2. How do we depreciate Assets in Oracle Applications?

3. What is the significance of asset books in FA? Types?

4.What is ment by retire asset? How do we retire assets in Oracle applications?

5. What are the various Journal Entries generated through fixed assets

6.At what level FA is implemented?

7.What is the profile used to secure asset register?

8.What are the asset types in FA Module?

9.What are the different calendars used in FA Module?

10.Is FA Supports Multi _org?

11.What is ment by Roll back depreciation?

12.What are the mandatory flexfiels used in FA?

13.What are the depreciation methods used in FA module?

14.What is ment by prorate convention?

15.What is the use of allow amortized changes check box?

16.What is the difference between Quick addition and detail addition?

17.What is ment by projection?

18.What is ment by what-if analysis?

19.What is ment by leased asset?

20.What is ment by depreciation override? Can we override depreciation?

21.What is ment by physical inventory reconciliation?

22.Tell me something about asset insurance?

23.What is ment by asset revaluation?

24.In prepare mass additions window what are available Q names?

25.what is the difference between initial mass copy and periodic mass copy?

26.what is internal retairment?

27.What experience do you have in FA Module Implementation?

28.What do you know about FA to GL cycle?

2. How do we depreciate Assets in Oracle Applications?

3. What is the significance of asset books in FA? Types?

4.What is ment by retire asset? How do we retire assets in Oracle applications?

5. What are the various Journal Entries generated through fixed assets

6.At what level FA is implemented?

7.What is the profile used to secure asset register?

8.What are the asset types in FA Module?

9.What are the different calendars used in FA Module?

10.Is FA Supports Multi _org?

11.What is ment by Roll back depreciation?

12.What are the mandatory flexfiels used in FA?

13.What are the depreciation methods used in FA module?

14.What is ment by prorate convention?

15.What is the use of allow amortized changes check box?

16.What is the difference between Quick addition and detail addition?

17.What is ment by projection?

18.What is ment by what-if analysis?

19.What is ment by leased asset?

20.What is ment by depreciation override? Can we override depreciation?

21.What is ment by physical inventory reconciliation?

22.Tell me something about asset insurance?

23.What is ment by asset revaluation?

24.In prepare mass additions window what are available Q names?

25.what is the difference between initial mass copy and periodic mass copy?

26.what is internal retairment?

27.What experience do you have in FA Module Implementation?

28.What do you know about FA to GL cycle?

Thursday, May 17, 2007

Multi - Org Setup

Multi-Org is a server-side (applications and database) enhancement that enables multiple business units in an enterprise to use a single installation of Oracle Applications products while keeping transaction data separate and secure. The Multi-Org enhancement uses native database views to build a security layer on top of a single installation of Oracle Applications. In Oracle Applications Release 11i,

Basic Business Needs

The Multi-Org enhancement to Oracle Applications provides features necessary to satisfy the following basic business needs. You should be able to:

• Use a single installation of any Oracle Applications product to support any number of business units, even if those business units use different sets of books.

• Support any number of business units within a single installation of Oracle Applications.

• Secure access to data so that users can access only information that is relevant to them.

• Procure products from an operating unit that uses one set of book, but receive them from another operating unit using a different set of books.

• Sell products from an operating unit that uses one set of books, but ship them from another operating unit using a different set of books, automatically recording the appropriate intercompany sales by posting intercompany accounts payable and accounts receivable invoices.

• Report at any level of the organizational structure

The Below is the structure of the Multi-Org

1.Login as sysadmin responsibility

2.Ddefine required responsibilities

Navigation:security->responsibility->define

3.Define user and assign responsibilities to the user.

N:Security->user->define.

4.Login as GL Responsibility

5.Define accounting flexfield

N:setup->financials->flexfield->key->segments

6.Give values for your segments

N:setup->financials->flexfield->key->values.

7.Define Currency

N:setup->Curriencies->define

8.Define Calender.

N:Setup->financials->calender->Type/Accounting

9.Create SOB N:Setup->financials->book->define

10.Login as HRMS responsibility.

11.Define a location N:Work Structure->Location

12.Define a Business Group

N:Works Structure->organization->description

13.Set the following Profile Options to all your responsibilities

HR:security

HR:bisiness group

HR:User Type

GL:Set of books name

14.Login As Inventoruy responsibility

15.Create legal entity

N:Setup->organizations->organizations

16.Create Operatiing unit N:Setup->organizations->organizations

17.Set Profile option Mo:Operating unit for all responsibilites which is worked at operating unit level.

18.Create Work day calender

19.Create inventory Organization.

N:Setup->organizations->organizations

20.Login as sysadmin and run replicate seed data program.

Basic Business Needs

The Multi-Org enhancement to Oracle Applications provides features necessary to satisfy the following basic business needs. You should be able to:

• Use a single installation of any Oracle Applications product to support any number of business units, even if those business units use different sets of books.

• Support any number of business units within a single installation of Oracle Applications.

• Secure access to data so that users can access only information that is relevant to them.

• Procure products from an operating unit that uses one set of book, but receive them from another operating unit using a different set of books.

• Sell products from an operating unit that uses one set of books, but ship them from another operating unit using a different set of books, automatically recording the appropriate intercompany sales by posting intercompany accounts payable and accounts receivable invoices.

• Report at any level of the organizational structure

The Below is the structure of the Multi-Org

1.Login as sysadmin responsibility

2.Ddefine required responsibilities

Navigation:security->responsibility->define

3.Define user and assign responsibilities to the user.

N:Security->user->define.

4.Login as GL Responsibility

5.Define accounting flexfield

N:setup->financials->flexfield->key->segments

6.Give values for your segments

N:setup->financials->flexfield->key->values.

7.Define Currency

N:setup->Curriencies->define

8.Define Calender.

N:Setup->financials->calender->Type/Accounting

9.Create SOB N:Setup->financials->book->define

10.Login as HRMS responsibility.

11.Define a location N:Work Structure->Location

12.Define a Business Group

N:Works Structure->organization->description

13.Set the following Profile Options to all your responsibilities

HR:security

HR:bisiness group

HR:User Type

GL:Set of books name

14.Login As Inventoruy responsibility

15.Create legal entity

N:Setup->organizations->organizations

16.Create Operatiing unit N:Setup->organizations->organizations

17.Set Profile option Mo:Operating unit for all responsibilites which is worked at operating unit level.

18.Create Work day calender

19.Create inventory Organization.

N:Setup->organizations->organizations

20.Login as sysadmin and run replicate seed data program.

Monday, April 30, 2007

Note On Indian localization

Oracle Applications was developed as a Global product.Because of this reason it does not supported by some acts like customs,central excise,vat,cst...etc which are mandatory according to Indian Laws.

All other contries are also having some contry specific requirements. To meet the above requirements Oracle developes software named patches.We can add this patches to the base product of the oracle applications.

Indian Localization is also one patch which meets the contry specific requirements.

What is India Localization Product?

India Localization is a solution built over Oracle E-Business Suite, Oracle's e-business applications software product, that provides Clients in India with the most comprehensive solution to comply with the India specific tax requirements as specified by Central Excise, Customs, Sales Tax and VAT, and Income Tax, (to the extent of tax deduction at source and generation of Depreciation Schedule for fixed assets). India Localization product also provides valuable information that can be used for statutory and management reporting.

What Does India Localization Product Do?The product uses its own tax engine, for handling taxes applicable across 'Procure to Pay' and 'Order to Cash' transactions.

In India Localization, taxes are defaulted based on the pre-determined setup (Tax Defaultation). Tax amounts are calculated based on precedence such as transaction base value, tax on tax, or assessable value as specified by tax authority (Tax Calculation). The Tax Amount is considered for inventory valuation, recoverability and accounting based on the pre-determined recoverability and accounting rules (Tax Accounting and Recoverability). Details of recoverable tax amount are recorded as part of the repository (Tax Recording). This information can further be used to calculate the final tax liability arising on settlement at the end of the tax period (Tax Settlement) and for statutory reporting (Tax Reporting).

Components of India Localization Product

Tax Defaultation

Tax Calculation and Recovery

Accounting for India Localization Taxes

Recording and Reporting Tax Information

All other contries are also having some contry specific requirements. To meet the above requirements Oracle developes software named patches.We can add this patches to the base product of the oracle applications.

Indian Localization is also one patch which meets the contry specific requirements.

What is India Localization Product?

India Localization is a solution built over Oracle E-Business Suite, Oracle's e-business applications software product, that provides Clients in India with the most comprehensive solution to comply with the India specific tax requirements as specified by Central Excise, Customs, Sales Tax and VAT, and Income Tax, (to the extent of tax deduction at source and generation of Depreciation Schedule for fixed assets). India Localization product also provides valuable information that can be used for statutory and management reporting.

What Does India Localization Product Do?The product uses its own tax engine, for handling taxes applicable across 'Procure to Pay' and 'Order to Cash' transactions.

In India Localization, taxes are defaulted based on the pre-determined setup (Tax Defaultation). Tax amounts are calculated based on precedence such as transaction base value, tax on tax, or assessable value as specified by tax authority (Tax Calculation). The Tax Amount is considered for inventory valuation, recoverability and accounting based on the pre-determined recoverability and accounting rules (Tax Accounting and Recoverability). Details of recoverable tax amount are recorded as part of the repository (Tax Recording). This information can further be used to calculate the final tax liability arising on settlement at the end of the tax period (Tax Settlement) and for statutory reporting (Tax Reporting).

Components of India Localization Product

Tax Defaultation

Tax Calculation and Recovery

Accounting for India Localization Taxes

Recording and Reporting Tax Information

Thursday, April 26, 2007

Form personalization

Introduction to Form personalization

Form personalization is a declarative feature that alters the look and behavior of the oracle forms with out changing base code. This concept was introduced in the release 11.5.10. All E-Business suit forms can be personalized

By using form personalization you can:1. Display your own terminology.

2. Stream lines the screen interaction.

3. Implement security policies.

4. Add your own validation and error messages.

There are some limitations:

1. You can only change what oracle forms allows to be changed at run time.

2. You can only respond to limited trigger events only.

3. Your changes may be overridden by oracle base code.

To Be Continued in the next post.........

Form personalization is a declarative feature that alters the look and behavior of the oracle forms with out changing base code. This concept was introduced in the release 11.5.10. All E-Business suit forms can be personalized

By using form personalization you can:1. Display your own terminology.

2. Stream lines the screen interaction.

3. Implement security policies.

4. Add your own validation and error messages.

There are some limitations:

1. You can only change what oracle forms allows to be changed at run time.

2. You can only respond to limited trigger events only.

3. Your changes may be overridden by oracle base code.

To Be Continued in the next post.........

Wednesday, April 25, 2007

AIM Documents .............

Hai Friends...as a functional consultant we should know about AIM.Please find the AIM Documents list..............

Business Process Architecture (BP)

BP.010 Define Business and Process Strategy

BP.020 Catalog and Analyze Potential Changes

BP.030 Determine Data Gathering Requirements

BP.040 Develop Current Process Model

BP.050 Review Leading Practices

BP.060 Develop High-Level Process Vision

BP.070 Develop High-Level Process Design

BP.080 Develop Future Process Model

BP.090 Document Business Procedure

Business Requirements Definition (RD)

RD.010 Identify Current Financial and Operating Structure

RD.020 Conduct Current Business Baseline

RD.030 Establish Process and Mapping Summary

RD.040 Gather Business Volumes and Metrics

RD.050 Gather Business Requirements

RD.060 Determine Audit and Control Requirements

RD.070 Identify Business Availability Requirements

RD.080 Identify Reporting and Information Access Requirements

Business Requirements Mapping

BR.010 Analyze High-Level Gaps

BR.020 Prepare mapping environment

BR.030 Map Business requirements

BR.040 Map Business Data

BR.050 Conduct Integration Fit Analysis

BR.060 Create Information Model

BR.070 Create Reporting Fit Analysis

BR.080 Test Business Solutions

BR.090 Confirm Integrated Business Solutions

BR.100 Define Applications Setup

BR.110 Define security Profiles

Application and Technical Architecture (TA)

TA.010 Define Architecture Requirements and Strategy

TA.020 Identify Current Technical Architecture

TA.030 Develop Preliminary Conceptual Architecture

TA.040 Define Application Architecture

TA.050 Define System Availability Strategy

TA.060 Define Reporting and Information Access Strategy

TA.070 Revise Conceptual Architecture

TA.080 Define Application Security Architecture

TA.090 Define Application and Database Server Architecture

TA.100 Define and Propose Architecture Subsystems

TA.110 Define System Capacity Plan

TA.120 Define Platform and Network Architecture

TA.130 Define Application Deployment Plan

TA.140 Assess Performance Risks

TA.150 Define System Management Procedures

Module Design and Build (MD)

MD.010 Define Application Extension Strategy

MD.020 Define and estimate application extensions

MD.030 Define design standards

MD.040 Define Build Standards

MD.050 Create Application extensions functional design

MD.060 Design Database extensions

MD.070 Create Application extensions technical design

MD.080 Review functional and Technical designs

MD.090 Prepare Development environment

MD.100 Create Database extensions

MD.110 Create Application extension modules

MD.120 Create Installation routines

Data Conversion (CV)

CV.010 Define data conversion requirements and strategy

CV.020 Define Conversion standards

CV.030 Prepare conversion environment

CV.040 Perform conversion data mapping

CV.050 Define manual conversion procedures

CV.060 Design conversion programs

CV.070 Prepare conversion test plans

CV.080 Develop conversion programs

CV.090 Perform conversion unit tests

CV.100 Perform conversion business objects

CV.110 Perform conversion validation tests

CV.120 Install conversion programs

CV.130 Convert and verify data

Documentation (DO)

DO.010 Define documentation requirements and strategy

DO.020 Define Documentation standards and procedures

DO.030 Prepare glossary

DO.040 Prepare documentation environment

DO.050 Produce documentation prototypes and templates

DO.060 Publish user reference manual

DO.070 Publish user guide

DO.080 Publish technical reference manual

DO.090 Publish system management guide

Business System Testing (TE)

TE.010 Define testing requirements and strategy

TE.020 Develop unit test script

TE.030 Develop link test script

TE.040 Develop system test script

TE.050 Develop systems integration test script

TE.060 Prepare testing environments

TE.070 Perform unit test

TE.080 Perform link test

TE.090 perform installation test

TE.100 Prepare key users for testing

TE.110 Perform system test

TE.120 Perform systems integration test

TE.130 Perform Acceptance test

PERFORMACE TESTING(PT)

PT.010 - Define Performance Testing Strategy

PT.020 - Identify Performance Test Scenarios

PT.030 - Identify Performance Test Transaction

PT.040 - Create Performance Test Scripts

PT.050 - Design Performance Test Transaction Programs

PT.060 - Design Performance Test Data

PT.070 - Design Test Database Load Programs

PT.080 - Create Performance Test TransactionPrograms

PT.090 - Create Test Database Load Programs

PT.100 - Construct Performance Test Database

PT.110 - Prepare Performance Test Environment

PT.120 - Execute Performance Test

Adoption and Learning (AP)

AP.010 - Define Executive Project Strategy

AP.020 - Conduct Initial Project Team Orientation

AP.030 - Develop Project Team Learning Plan

AP.040 - Prepare Project Team Learning Environment

AP.050 - Conduct Project Team Learning Events

AP.060 - Develop Business Unit Managers’Readiness Plan

AP.070 - Develop Project Readiness Roadmap

AP.080 - Develop and Execute CommunicationCampaign

AP.090 - Develop Managers’ Readiness Plan

AP.100 - Identify Business Process Impact onOrganization

AP.110 - Align Human Performance SupportSystems

AP.120 - Align Information Technology Groups

AP.130 - Conduct User Learning Needs Analysis

AP.140 - Develop User Learning Plan

AP.150 - Develop User Learningware

AP.160 - Prepare User Learning Environment

AP.170 - Conduct User Learning Events

AP.180 - Conduct Effectiveness Assessment

Production Migration (PM)

PM.010 - Define Transition Strategy

PM.020 - Design Production Support Infrastructure

PM.030 - Develop Transition and Contingency Plan

PM.040 - Prepare Production Environment

PM.050 - Set Up Applications

PM.060 - Implement Production Support Infrastructure

PM.070 - Verify Production Readiness

PM.080 - Begin Production

PM.090 - Measure System Performance

PM.100 - Maintain System

PM.110 - Refine Production System

PM.120 - Decommission Former Systems

PM.130 - Propose Future Business Direction

PM.140 - Propose Future Technical Direction

Business Process Architecture (BP)

BP.010 Define Business and Process Strategy

BP.020 Catalog and Analyze Potential Changes

BP.030 Determine Data Gathering Requirements

BP.040 Develop Current Process Model

BP.050 Review Leading Practices

BP.060 Develop High-Level Process Vision

BP.070 Develop High-Level Process Design

BP.080 Develop Future Process Model

BP.090 Document Business Procedure

Business Requirements Definition (RD)

RD.010 Identify Current Financial and Operating Structure

RD.020 Conduct Current Business Baseline

RD.030 Establish Process and Mapping Summary

RD.040 Gather Business Volumes and Metrics

RD.050 Gather Business Requirements

RD.060 Determine Audit and Control Requirements

RD.070 Identify Business Availability Requirements

RD.080 Identify Reporting and Information Access Requirements

Business Requirements Mapping

BR.010 Analyze High-Level Gaps

BR.020 Prepare mapping environment

BR.030 Map Business requirements

BR.040 Map Business Data

BR.050 Conduct Integration Fit Analysis

BR.060 Create Information Model

BR.070 Create Reporting Fit Analysis

BR.080 Test Business Solutions

BR.090 Confirm Integrated Business Solutions

BR.100 Define Applications Setup

BR.110 Define security Profiles

Application and Technical Architecture (TA)

TA.010 Define Architecture Requirements and Strategy

TA.020 Identify Current Technical Architecture

TA.030 Develop Preliminary Conceptual Architecture

TA.040 Define Application Architecture

TA.050 Define System Availability Strategy

TA.060 Define Reporting and Information Access Strategy

TA.070 Revise Conceptual Architecture

TA.080 Define Application Security Architecture

TA.090 Define Application and Database Server Architecture

TA.100 Define and Propose Architecture Subsystems

TA.110 Define System Capacity Plan

TA.120 Define Platform and Network Architecture

TA.130 Define Application Deployment Plan

TA.140 Assess Performance Risks

TA.150 Define System Management Procedures

Module Design and Build (MD)

MD.010 Define Application Extension Strategy

MD.020 Define and estimate application extensions

MD.030 Define design standards

MD.040 Define Build Standards

MD.050 Create Application extensions functional design

MD.060 Design Database extensions

MD.070 Create Application extensions technical design

MD.080 Review functional and Technical designs

MD.090 Prepare Development environment

MD.100 Create Database extensions

MD.110 Create Application extension modules

MD.120 Create Installation routines

Data Conversion (CV)

CV.010 Define data conversion requirements and strategy

CV.020 Define Conversion standards

CV.030 Prepare conversion environment

CV.040 Perform conversion data mapping

CV.050 Define manual conversion procedures

CV.060 Design conversion programs

CV.070 Prepare conversion test plans

CV.080 Develop conversion programs

CV.090 Perform conversion unit tests

CV.100 Perform conversion business objects

CV.110 Perform conversion validation tests

CV.120 Install conversion programs

CV.130 Convert and verify data

Documentation (DO)

DO.010 Define documentation requirements and strategy

DO.020 Define Documentation standards and procedures

DO.030 Prepare glossary

DO.040 Prepare documentation environment

DO.050 Produce documentation prototypes and templates

DO.060 Publish user reference manual

DO.070 Publish user guide

DO.080 Publish technical reference manual

DO.090 Publish system management guide

Business System Testing (TE)

TE.010 Define testing requirements and strategy

TE.020 Develop unit test script

TE.030 Develop link test script

TE.040 Develop system test script

TE.050 Develop systems integration test script

TE.060 Prepare testing environments

TE.070 Perform unit test

TE.080 Perform link test

TE.090 perform installation test

TE.100 Prepare key users for testing

TE.110 Perform system test

TE.120 Perform systems integration test

TE.130 Perform Acceptance test

PERFORMACE TESTING(PT)

PT.010 - Define Performance Testing Strategy

PT.020 - Identify Performance Test Scenarios

PT.030 - Identify Performance Test Transaction

PT.040 - Create Performance Test Scripts

PT.050 - Design Performance Test Transaction Programs

PT.060 - Design Performance Test Data

PT.070 - Design Test Database Load Programs

PT.080 - Create Performance Test TransactionPrograms

PT.090 - Create Test Database Load Programs

PT.100 - Construct Performance Test Database

PT.110 - Prepare Performance Test Environment

PT.120 - Execute Performance Test

Adoption and Learning (AP)

AP.010 - Define Executive Project Strategy

AP.020 - Conduct Initial Project Team Orientation

AP.030 - Develop Project Team Learning Plan

AP.040 - Prepare Project Team Learning Environment

AP.050 - Conduct Project Team Learning Events

AP.060 - Develop Business Unit Managers’Readiness Plan

AP.070 - Develop Project Readiness Roadmap

AP.080 - Develop and Execute CommunicationCampaign

AP.090 - Develop Managers’ Readiness Plan

AP.100 - Identify Business Process Impact onOrganization

AP.110 - Align Human Performance SupportSystems

AP.120 - Align Information Technology Groups

AP.130 - Conduct User Learning Needs Analysis

AP.140 - Develop User Learning Plan

AP.150 - Develop User Learningware

AP.160 - Prepare User Learning Environment

AP.170 - Conduct User Learning Events

AP.180 - Conduct Effectiveness Assessment

Production Migration (PM)

PM.010 - Define Transition Strategy

PM.020 - Design Production Support Infrastructure

PM.030 - Develop Transition and Contingency Plan

PM.040 - Prepare Production Environment

PM.050 - Set Up Applications

PM.060 - Implement Production Support Infrastructure

PM.070 - Verify Production Readiness

PM.080 - Begin Production

PM.090 - Measure System Performance

PM.100 - Maintain System

PM.110 - Refine Production System

PM.120 - Decommission Former Systems

PM.130 - Propose Future Business Direction

PM.140 - Propose Future Technical Direction

Tuesday, April 24, 2007

Oracle Implementation Methodalagy

SUMMARY NOTES ON AIM

Application Implementation Method is a provan approach, which specifies all the activities which are required to implement oracle applications successfully.

The scope of the AIM is enterprise wide.

There are eleven processes of implementation.

1. Business Process Architecture[BP]

This phase explains

Existing business practices

Catalog change practices

Leading practices

Future practices

2. Business Requirement Definition[RD]

This phase explains about the

Base line questionnaire and

The gathering of information.

3. Business Requirement Mapping[BR]

In this phase we can match all the requirements of business with the standard functionality of the oracle applications.

If all the requirements match with oracle standard (with out customization) functionality then, it is called as vanilla implementation).

4. Application and Technical Architecture [TA]

Explains the infrastructure requirements to implement oracle applications.

For example:

desktops

software

hardware

Application Implementation Method is a provan approach, which specifies all the activities which are required to implement oracle applications successfully.

The scope of the AIM is enterprise wide.

There are eleven processes of implementation.

1. Business Process Architecture[BP]

This phase explains

Existing business practices

Catalog change practices

Leading practices

Future practices

2. Business Requirement Definition[RD]

This phase explains about the

Base line questionnaire and

The gathering of information.

3. Business Requirement Mapping[BR]

In this phase we can match all the requirements of business with the standard functionality of the oracle applications.

If all the requirements match with oracle standard (with out customization) functionality then, it is called as vanilla implementation).

4. Application and Technical Architecture [TA]

Explains the infrastructure requirements to implement oracle applications.

For example:

desktops

software

hardware

people...etc

5. Build and Module Design[MD]

In this phase concentrate on developing the new functionality which is required by the client.

This is called customization.

In this phase explains how to design a forms, database and reports...

6. Data Conversion:[CV]

Is the process of converting or transferring the data from legacy system to oracle applications? This is called as data migration.

Ex: transferring the closing balances of the previous year as an opening balances to next year.

7. Documentation:[DO]

I

n this phase we have to prepare module wise user guides and implementation manuals which helps in the implementation.

8. Business System Testing:[TE]

A process of validating the setup’s and the functionality by a tester to certify its status is allied business system testing. It is done by a functional consultant.

9. Performance Testing:[PT]

Performance testing means evaluation of transaction saving time, transaction retrieval times. It is done by a technical team.

10; Adoption and Learning.[AP]

This phase explains about the removal of the legacy system of the client. The entire user should be trained with new oracle applications. In this phase we have to prepare user manuals.

11. Production Migration[PM]

A process of decommissioning of legacy system and the usage of new oracle application system begins in this phase.

5. Build and Module Design[MD]

In this phase concentrate on developing the new functionality which is required by the client.

This is called customization.

In this phase explains how to design a forms, database and reports...

6. Data Conversion:[CV]

Is the process of converting or transferring the data from legacy system to oracle applications? This is called as data migration.

Ex: transferring the closing balances of the previous year as an opening balances to next year.

7. Documentation:[DO]

I

n this phase we have to prepare module wise user guides and implementation manuals which helps in the implementation.

8. Business System Testing:[TE]

A process of validating the setup’s and the functionality by a tester to certify its status is allied business system testing. It is done by a functional consultant.

9. Performance Testing:[PT]

Performance testing means evaluation of transaction saving time, transaction retrieval times. It is done by a technical team.

10; Adoption and Learning.[AP]

This phase explains about the removal of the legacy system of the client. The entire user should be trained with new oracle applications. In this phase we have to prepare user manuals.

11. Production Migration[PM]

A process of decommissioning of legacy system and the usage of new oracle application system begins in this phase.

Subscribe to:

Posts (Atom)